Tax Free Retirement

Tax deferred or tax free? Tax deduction now and pay later? Pay now and tax free later? The path to a financially independent retirement is not always clear. Connect with a retirement specialist today to engineer the retirement you deserve!

Want to know how to create tax-free retirement income? Our retirement experts have been working with individuals to mitigate tax implications for a virtually tax-free retirement.

Unfortunately, we do not get to stop paying taxes when we stop working. A lot of retirement income can still be taxable, even if it is not directly from employment. However, not all income is subject to federal taxes. You could potentially avoid paying some federal income taxes on various types of retirement income.

There are many strategies to remember to implement when you want to get as close to having a tax-free retirement as possible. Our independent insurance agents will answer all your questions about tax-free retirement strategies.

Contact us today for personalized help!

There's a diverse range of strategies for achieving a tax-free retirement, and we specialize in helping both individuals and businesses minimize their tax burdens. Utilizing a variety of these strategies can significantly enhance your income potential in retirement. Remember, once you've retired, any taxes owed will be deducted from your retirement savings, so it's crucial to maximize the efficiency of your funds.

Tax-free retirement strategies encompass options like contributing to a Roth IRA, leveraging a Health Savings Account (HSA), investing in municipal bonds, benefiting from long-term capital gains rates, holding a permanent life insurance policy, utilizing annuities, and understanding the tax aspects of your Social Security benefits.

Each retirement plan is unique, just like your individual circumstances. That's why it's essential to collaborate with a skilled professional who can tailor a strategy to fit your specific needs and goals, ensuring your retirement funds are optimized to support your golden years.

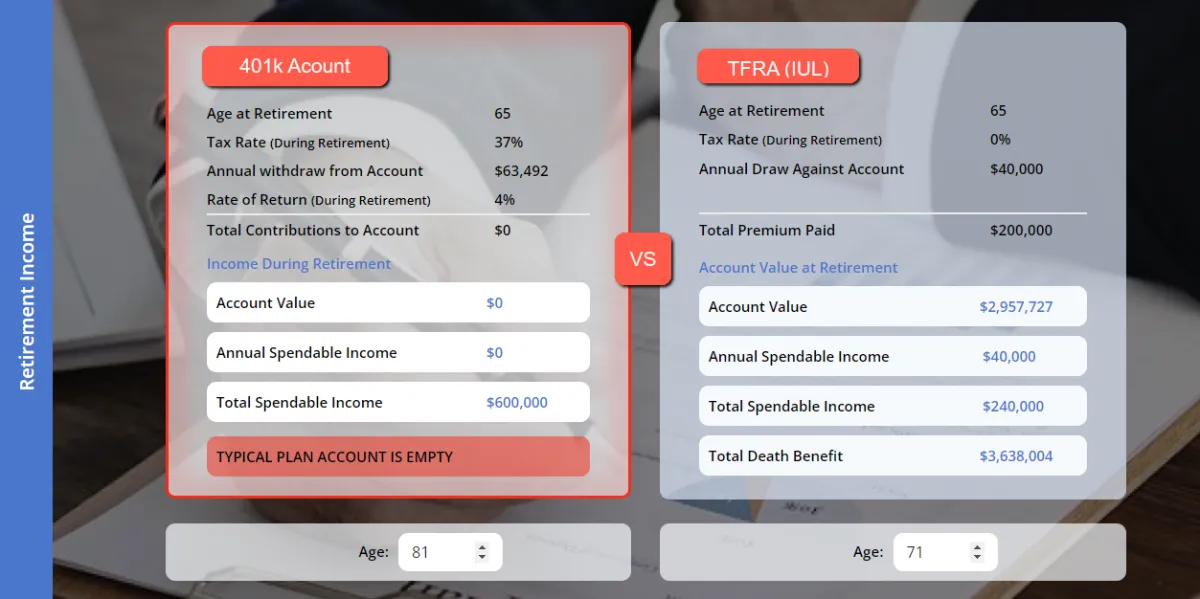

Securing Your Future: How Long Will Your Retirement Account Last?

A Tax-Free Retirement Account (TFRA), akin to a Roth IRA, is a retirement savings plan where contributions are made with after-tax dollars, allowing the growth to be tax-free. However, TFRAs offer more flexibility than Roth IRAs, notably in the absence of IRS restrictions on withdrawals. This makes them particularly advantageous for individuals expecting to be in a higher tax bracket upon retirement.

One unique feature of TFRAs is the "floor" mechanism. While your funds are indexed to the market, they are not directly invested in it. This means you benefit from market upswings with credited gains, but don’t face losses when the market declines. Unlike many retirement accounts constrained by IRA limitations, TFRAs offer more accessible fund liquidity.

Additionally, TFRAs provide benefits for chronic, critical, and terminal illnesses, akin to long-term care coverage, and include a permanent death benefit from day one. These accounts are essentially specialized life insurance plans optimized to leverage tax laws. While they are free from the contribution limits typical of qualified retirement plans, they must comply with life insurance regulations.